THERE’S a reason I became a journalist. Like alcohol and Mel Gibson, numbers and I don’t mix very well. So when my number-genius friend Amie and I started talking family finances and spendthrift husbands (mine, at least), it made sense to ask her to write something on how she manages the family budget. While as the treasurer of the household I sometimes think I’m doing a better job than Wayne Swan, there is certainly room for improvement. And Amie’s tips are so easy to follow and implement.

By Amie Bramich

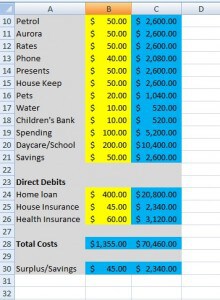

This is my budgeting technique that has been with me since I first moved out of home; it has evolved through uni, buying a home, a wedding and now a family.

It is not complicated but it does seem to be working fairly efficiently for us as a family, I think it would be suitable for those who pool their incomes and those who like to keep them separate. It is ideal for keeping track of those day-to-day living expenses! You don’t need much – a list of your costs broken down to your particular income frequency and a few envelopes.

Below is a step-by-step guide for getting started and a few tips along the way!

1. Identify regular income sources and frequency

- I have tended to not include bonus income such as tax refunds; but rather see these as a savings bonus or for special family treats such as mini breaks.

2. Identify as best you can all regular fixed costs.

- This can seem a daunting task, I have found that it is best to not over think this, rather let it naturally evolve with your budget.

- Keep the categories broad and leave a little room in your allocations for those unexpected items.

3. Now check your totals!

- I have always done this out to a weekly and an annual level, ensuring your income covers your costs on pay day and over the year.

- This is an interesting exercise as it gives you a big picture of where your cash is going!

4. Label envelopes (or if you prefer a folder) as you have cash expenses with the required amounts. Then as the bills roll in you have the cash needed!

This technique can be adapted for those who prefer to leave their cash in the bank account with a spreadsheet instead of envelopes.

In my experience the hardest part of this technique (and any other budgeting method) is sticking to it! Also, try not to “borrow” from your bill stash, this can lead to trouble!

You can download a larger version of the test budget worksheet by clicking the image. NB: Aurora is the supplier of Tasmania’s electricity.

Do you have a technique for managing the family budget? Or, like me, do you battle a spendthrift husband?

I love the idea of the envelopes. That would really help our household. We seem to always be dipping into savings. Thanks.

I feel the same, Jill. Love to hear how you go with it. x

I had a spendhappy husband which meant I worked all hours to support his lifestyle. Event though I am now single, and don’t have the luxury of that extra income, it’s a relief to pay for what we need as we need it, and not to go into debt. But it’s still tough on a single-income, and I don’t really have the answers …)

I’m not sure what to say, Bronnie. I hope you’re able to find your answers soon. xx